home ¦ what’s on ¦ drinks ¦ classic album festival ¦ bands ¦ links ¦ about us ¦ private hire ¦ accommodation ¦ music store ¦ faq

Welcome to The Portland Hotel and Rock Bar

The Portland is a LIVE music venue, in addition we screen all major sporting events on our large screen TVs

Are you in a band that wants to play The Portland? Click on BANDS for more info

This website (and most of the web)

looks better in Firefox!

NEW! Get the Portland on your Mobile!

Got web access on your mobile? The just browse to www.theportland.mobi for up to the minute gig information. And don’t forget to set a bookmark!

replica watches

Future Events

The Portland Wednesday Originals Nights

From October the 4th The Portland Rock Bar will be hosting a weekly event every Wednesday night showcasing original local talent. Each night will feature 3 bands performing their own material. If you would like to participate in these events please e-mail [email protected] with details of your band, visit myspace.com/portlandrockbar for further information

Portland Classic Album Festival

Tickets are now available to purchase online for the first ”Portland Classic Albums Festival” which will take place between February 2nd and 13th 2007. Each night will feature a leading tribute act performing a complete genre defining album from start to finish plus a selection of further classic material from the artists repertoire.

For more information click here

Pick ‘n’ Mix tickets available – see ticketweb for more details

Tonight at the Portland

Portland Classic Albums Festival

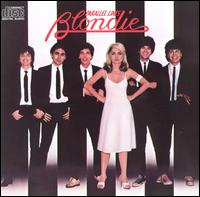

Call Me performing Blondie’s Parallel Lines album.

Band link: www.blondie-tribute-band.co.uk

Purchase tickets: ticketweb

Price: £5

Starts: 8.30pm approx, doors 7.30pm

Contact Us

t: 01273 383840

e: [email protected]

p: 153 Portland Road,

Hove, BN3 5QJ

Map Portland Hotel & Rock Bar on Multimap

Getting Here

By Bus:

Brighton & Hove Buses

Regular service: 2,46,49

Occasional services: 7,25

Night Bus: N25, links with N7

Coming from Brighton it’s the 3rd stop on Portland Rd.

By Train:

We are about 5 minutes walk to Aldrington Halt (occasional service), whilst 10-15 minutes walk from both Portslade and Hove Stations

By Car:

There is ample parking around the Portland, but unless you’re on the soft drinks we’d suggest leaving the car at home! Please note that restrictions now apply at certain times of the day.

Opening Hours

Mon – Wed: 11am-11pm

Thursday: 11am-11.30pm

Fri – Sat: 11am-1am

Sunday: 12noon-10.30pm

Happy Hours

Monday-Saturday: 5-7pm

Sundays: 12.30-2pm

Beer of the week £2.00

Most draught beers £2.30

Discounts on house spirits and wine

The Ultimate Iget Bar Flavours Series showcases an array of enticing iget vape flavours that cater to every palate. From the refreshing burst of tropical fruits to the rich, creamy indulgence of desserts, each flavour is meticulously crafted to deliver a satisfying vaping experience. Whether you’re a novice or a seasoned vaper, exploring these flavours will elevate your enjoyment and keep you coming back for more.